So, let's talk again about the main patterns that will help you determine further price behavior with high accuracy. In the last article, we learned about the main reversal signals - Dojis and Stars. Let's take a look at a few more.

Hammer and Hanging Man

Two more well-known reversal combinations. On the chart, they look almost identical. It all depends on the direction of the trend after which the pattern has formed.

Hammer, also known as a pin bar, and the hanging man can be distinguished by the following features:

- Short main body.

- A long shadow on the bottom that exceeds the size of the body at least twice.

- Short or completely missing upper shadow.

- The hammer comes in both colors while the hanging man is only black (bearish).

Examples of Hammer and Hanging Man

The hammer appears on the chart after an active downtrend. From the long tail, we make a conclusion that the bears made every effort to lower the price but the bulls were stronger. That’s what caused the formation of a short body. Before entering the trade, wait for the confirmation of the signal. The best option would be a rising candle with a long body.

The hanging man signals a bearish reversal. The candle appears after a steady uptrend. The reversal here is also indicated by a long tail. It shows that the sellers have actively entered the game. However, they couldn’t significantly reduce the price. Make sure to wait until the next candle closes. If you see a big downward candlestick, the price will most likely continue to drop.

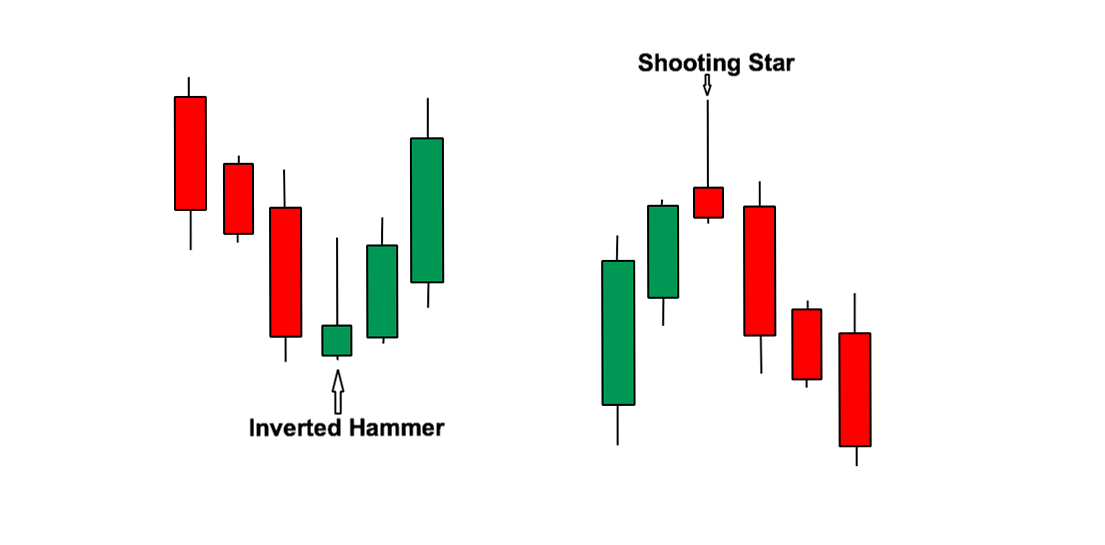

Inverted Hammer and Shooting Star

Additional reversal patterns. They are similar to the previous ones but have a long tail at the top In other features, the candles are the same: a small main body and a short or completely absent lower shadow.

Examples of Shooting Star and Inverted Hammer

Where do these patterns appear and what do they show:

- The inverted hammer forms in a bearish trend at the support level and gives a signal of an imminent upward market turn. The long upper wick in this case indicates a high activity of buyers, and a small body indicates a weakening of sellers. Therefore, after confirming the signal with a rising candle, you can safely open a buy trade or close your sell position, if you have any.

- The shooting star, obviously, mirrors the previous pattern. It forms around the resistance of an active uptrend. The long tail tells us that the bulls showed their maximum and the bears are taking over them. Wait for a big downward candle to confirm the signal and open a short trade. If you have an active long position, close it cause the price will continue to fall with high probability.

Spinning Top and Bottom

Another pattern formed by one candlestick. It can be identified by the small main body and long identical shadows at the top and bottom.

Examples of Spinning Top and Bottom

The structure of the candle suggests that both, the bears and the bulls, were able to push the price quite strongly, forming long tails. Nevertheless, the forces were equal as the main body of the candlestick is quite small.

The pattern speaks of market uncertainty. If a spinning top forms in an uptrend, the market is likely to go down. A spinning bottom in a bearish trend signals a reversal to the upside.

Abandoned Baby

This pattern might remind you of the evening and morning stars. The composition always includes three candles:

- Bearish

- Doji

- Bullish

Examples of Abandoned Baby

An abandoned baby is necessarily represented by one Doji between two candles with different directions. In this case, the middle candle is located at some distance from the other two. This is where the name abandoned baby comes from.

This pattern also speaks of a reversal but is valid only if it is formed around important price levels. In an uptrend, it is represented by a bullish candle, Doji, and a bearish candle. In a descending trend, the candlesticks are mirrored.

Some experienced traders recommend waiting for the formation of several candles after the abandoned baby. However, in this case, you may miss a good trading opportunity. Many traders open a transaction after the closure of the very next candle in the right direction but they always use additional indicators to confirm the signal.

Let's end here for today. But don’t think that is all. Ahead, we have a few more extremely useful candlestick patterns, but let’s leave them for the next article.

Reversal Candlestick Patterns FAQ

How to identify a reverse pattern?

The best way to find a reversal candlestick is to follow the trend. When the price breaks through an existing trend line, and you get a confirming candle, a chart reversal usually begins.

Is a hammer candlestick bullish or bearish?

A hammer candlestick is a bullish signal that usually forms at the bottom of the chart and indicates a possible reversal.

How long do patterns usually last in trading?

There is no exact time duration for each pattern. Some can take minutes, while others may last for years. Expert traders recommend analyzing various timeframes and weighing entry points carefully.

What is the most reliable reversal pattern?

The head and shoulder pattern is Forex's most powerful reversal pattern since it is elementary, even for beginner traders.

Are reversal candlesticks the same for Forex and other markets?

Yes, reversal patterns can be used in foreign exchange like in other markets, for example, stock, crypto, etc.